AI Did Not Arrive Suddenly in Banking. We Have Been Here Before.

In 2017, long before generative tools entered boardroom language, I authored a whitepaper for financial service marketers explaining a simple but uncommon idea: artificial systems were neither magical nor novel. They already sat quietly inside platforms banks used each day.

What felt different at that point was the widening gap between belief and outcome.

A large, well-known blue-chip financial institution had invested heavily in a leading marketing automation system, expecting growth lift, staff reduction, and reduced reliance on outside partners. Twelve months later, the SVP learned a hard lesson: insight does not appear simply because software gets deployed. That moment was not rare. It reflected a repeatable pattern.

Nearly a decade later, that same dynamic has resurfaced, now tied to generative tools.

The limiting factor then, as now, was never whether intelligence existed. It was whether large, regulated institutions had a practical, low-risk way to apply it inside real operating constraints, including governance, fragmented data, legacy platforms, and organizational silos.

AI Has Always Moved in Cycles and Banking Knows This Well

The current moment feels unique only without context. History shows repeated swings. Early optimism. Public funding. Eventual disappointment. Renewal once compute power and usable data align.

Financial institutions, however, never fully exited this space.

Credit scoring, fraud detection, call routing, risk modeling, and message optimization have relied on statistical learning and machine logic for many years. The distinction has never been usage, but intent.

These systems were intelligent, but they were rarely adaptive in ways marketing and customer experience now demand. They produced outputs, not learning loops, and they were not designed to be reused, governed, and evolved across channels.

A Parallel Example Outside Banking

This pattern is not unique to financial services. Google has relied on machine learning for decades across search relevance, advertising optimization, spam filtering, and language prediction. None of these capabilities arrived fully formed, and none were framed as sudden revolutions. They evolved quietly through data, iteration, and operating discipline.

The same arc applies to banking. Intelligence compounds over time when systems are designed to learn, not when tools are added for effect.

The Forgotten Architecture Big Data, Data Science, and Machine Learning

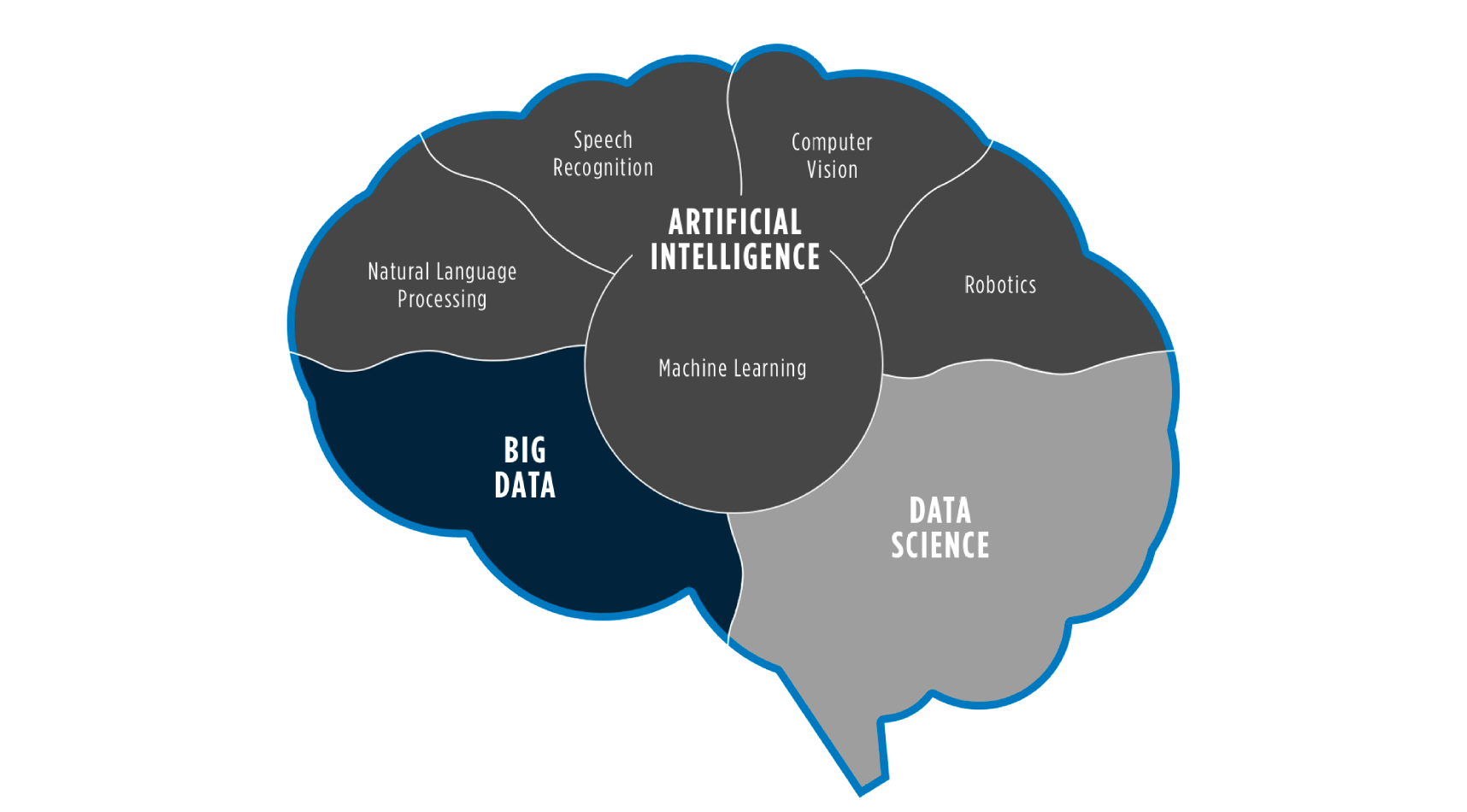

One core claim in the 2017 paper focused on structure. AI is not a single function. It is a system built from three linked disciplines.

Big Data made storage inexpensive and scale feasible.

Data Science turned raw information into usable signals.

Machine Learning introduced adaptation over time without hard coding.

That final layer acts like a cognitive front end. Without it, speech systems, language interpretation, offer relevance, and decision logic remain rigid and rule bound.

This framing still matters because many organizations mistake interface sophistication for real intelligence.

Shallow Learning, Deep Learning, and Why Banks Began Small

The paper drew a clear distinction that remains relevant today.

Shallow approaches such as linear methods, rules engines, and manual feature design powered early use cases like pricing optimization, churn prediction, and response modeling. Deep systems reduced the need for feature engineering by allowing models to learn structure directly from data, though at higher cost and risk.

Banks adopted shallow approaches first not because of technical limitation, but because of control. These models could be tested, traced, tuned, and defended, traits vital within regulated environments.

Today, rapid tool growth is quietly restoring respect for those same constraints.

The Real Through Line Relevance, Not AI Ornamentation

The most undated idea in the 2017 paper had little to do with algorithms or code.

It focused on how marketing should feel to a customer.

The objective was not faster campaigns or higher message volume. It was interaction that adapts. Each touch responds to prior behavior, present context, and implied intent rather than fixed schedules or static journeys.

That idea maps directly to how teams now describe journey orchestration, real-time decisioning, owned channel intelligence, and personalization at scale.

The objective has not changed. Only the tools have evolved.

What This Means Now

AI does not replace judgment, strategy, or operating discipline. It amplifies them or exposes their absence.

For financial services leaders, credibility with AI does not come from adopting the newest model or chasing the latest interface. It comes from knowing how intelligence is introduced, tested, governed, and scaled inside complex institutions.

Many organizations today find themselves trapped between experimentation and production. Proofs of concept show promise but fail to survive governance review, platform constraints, or organizational handoff. The result is pilot purgatory, insight without institutional progress.

Having spent years modernizing email personalization, arguably the most constrained owned channels in banking, it became clear that success requires more than capable models. It requires a disciplined system for testing, learning, and deciding what earns the right to scale.

PilotLaunch.AI was created in response to that gap: to give banks a controlled experimentation loop that they can reuse, govern, and scale as they bring AI-enabled personalization from ambition into production reality. Rather than starting with tools or channels, the focus is on standing up governed pilot environments that produce evidence leadership can trust.

Email proved that relevance could work under maximum constraint. Cross-channel experiences now demand orchestration, persistent state, and shared decisioning, problems that require system design, not isolated execution.

The institutions that move forward successfully will not be the loudest adopters. They will be the most deliberate builders.

That is why this moment feels familiar. And why experience, structure, and restraint matter more now than at any point before.

About PilotLaunch.AI

PilotLaunch.AI is a strategy-led advisory that helps consumer banks modernize customer experience and AI adoption through structured, controlled experimentation, supported by proprietary methodologies and purpose-built technology. We work with bank teams to define high-value use cases, establish clear guardrails and success metrics, and stand up disciplined pilot environments that turn ambition into evidence and evidence into production-ready outcomes.